It seems like futures traders have been waiting forever for a Fed rate hike.

Fed Chair Janet Yellen and team have kept traders guessing, but the first U.S. interest rate hike since June 2006 is still expected to be the main event for futures markets in 2015.

The Fed's main policy tool —the federal funds rate —has been at a historic zero to 0.25% since December 2008. Fed officials have loudly broadcast their intentions to exit from its zero-interest rate policy this year. But, mixed signals about the strength in the economic picture along with lower than ideal levels of inflation have held the Fed back from its first move to date.

The timing of the first rate hike is still up in the air and will be a closely monitored event throughout the summer months.

Here are key dates to set alerts for— especially if you are making your summer vacation plans now.

Upcoming Federal Open Market Committee (FOMC) meetings:

- June 16-17* this meeting includes a press conference

- July 28-29

- September 16-17* this meeting includes a press conference

- October 27-28

- December 15-16* this meeting includes a press conference

Historically, the first six months after a Fed interest rate hike has seen a higher amount of uncertainty in the stock market with a small 1% return on the S&P 500 on average. The expectations for a rate hike will impact a wide array of futures markets from stock index futures to the dollar index to gold, with the potential for increased volatility and summer fireworks. Increased volatility can mean increased opportunity for traders.

Let's take a look at three futures markets to see what could be in store this summer.

S&P 500 Futures

The current bull market in U.S. stocks is over six years old. Historically that is getting a bit long in the tooth. The latest bull cycle began in March 2009. But, only two of the prior 11 bull markets since WWII made it to year seven, according to research from S&P Capital IQ. Throw in higher interest rates, which are typically negative for the stock market and S&P futures are vulnerable to potential volatility or even a corrective pullback this summer or fall.

Traditionally, the summer months are a quiet time in financial markets, with many traders away on vacation and more concerned about their tans than trading screens. Less participation can mean more illiquidity, which can lead to higher volatility.

Take a look at Figure 1 —a daily picture of the June S&P 500 contract. Daily momentum, seen below the price bars reveals a bearish divergence. While the S&P contract hit new highs in late April, momentum registered a lower reading than in February. This is a red flag warning signal for the bulls. The 200-day moving average, shown in blue, reveals long-term support for the S&P contract. Traders will be watching that line closely if any corrective pullbacks appear in the days or weeks ahead. Sustained declines under the 200-day moving average would be viewed as a bearish event.

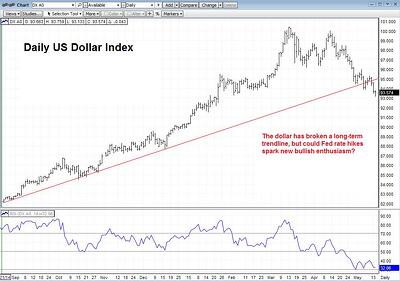

Dollar Index

The U.S. dollar index and dollar index futures see significant impact from monetary policy expectations. Analysts say a large part of the monster rally move that unfolded since September 2014 (look left on the daily chart in Figure 2) was driven by expectations for higher U.S. rates. Many other major central banks around the globe, including the European Central Bank and the Bank of Japan are still embarking on substantial easing policies in efforts to strengthen their sluggish economies. The Fed was expected to one of the few major central banks hiking rates in 2015.

Futures markets are forward thinking animals and the dollar index priced in expectations for interest rates hikes months ago. The subsequent uncertainty following weaker-than-expected first quarter U.S. economic data sent the dollar tumbling lower as traders "de-priced" some of those expectations.

Going forward, dollar action will be finely attuned to Fed moves, including expectations and hints on how high and how fast the federal funds rate could move this year and in 2016. The dollar could be poised for a recovery move higher once the Fed rate hikes kick into high gear.

Comex Gold Futures

A third market poised for potential volatility and movement this summer and fall is gold. The precious metal is driven by a variety of fundamental factors including expectations for interest rate policy. In the wake of the global financial crisis in 2008, the Fed's massive quantitative easing programs and monetary policy accommodation sent gold futures to all-time highs above the $1,900 per ounce level in late 2011. A key bullish driver was ideas that the quantitative easing programs detracted from the value of the dollar (a paper currency), while gold (a hard commodity and safe-haven) was seen as an alternative store of value.

While a Fed rate hike could leave gold vulnerable to a test of lower price levels, other factors are at play in the gold market arena. The world's growing Asian economies continue to boast a strong appetite for the yellow metal with Chinese and Indian consumers now accounting for 54 percent of all consumer gold demand, according to the World Gold Council. Eastern gold buyers have a strong time-honored history and cultural affinity to purchase gold as a store of wealth. As the middle class continues to grow in that part of the world, gold demand is expected to continue to rise.

Some analysts expect physical demand to emerge on price drops as longer-term buyers view the decline as a buying opportunity. Longer-term investors are attracted to gold for portfolio diversification, as the yellow metal has a nearly zero correlation to stocks. Gold is also viewed as a portfolio hedge and safe-haven against financial market collapse or severe economic problems.

Investment demand continues to climb for gold. In the first quarter, investment demand gained 4 percent to 279 tons, with 26 tons of net inflows into gold-backed Exchange Traded Funds (ETFs), according to the World Gold Council.

The longer-term investment demand could play an opposing force to the negative pressure from potential Fed rate hikes this year. Figure 3 shows a weekly chart of nearby gold futures, with support levels circled. Physical demand has tended to emerge on dips as longer-term buyers shop for bargain.

Summer doldrums: maybe, maybe not. Depending on when the Federal Reserve decides to pull the trigger on its first rate hike could mean fireworks and volatility for a number of futures markets this summer last well beyond the Fourth of July. Get ready.

Related Reading: Learn more about futures trading costs here.